|

MEMPHIS, Tenn. – The green industry’s first national landscape firm, created 12 years ago in an unprecedented and high value merger, sold in March at a fire sale price to a private equity firm. MEMPHIS, Tenn. – The green industry’s first national landscape firm, created 12 years ago in an unprecedented and high value merger, sold in March at a fire sale price to a private equity firm.

Aurora Resurgence, part of a $2 billion Los Angeles-based investment firm, bought ServiceMaster’s commercial landscape division for just shy of $38 million – a fraction of the $250 million ServiceMaster paid for it in 1999.

What it means to you

The sale, which had been hinted at since last November, brings another private equity player into the mature landscape industry, and could lead to more acquisitions.

Ron Edmonds, president of the M&A firm Principium, says the move by Aurora bodes well for the industry.

“We have a new player in the market that may be an acquirer. Certainly, TruGreen LandCare hasn’t made any acquisitions in years. I see that as a positive to the market,” Edmonds says. “It’s also another vote from the private equity community, indicating that they believe there’s strength in the industry.”

Brian Corbett, principal at CCG Advisors, echoed Edmonds’ comments.

“Owners of landscape maintenance companies of all sizes should be encouraged by Aurora’s vote of confidence in TruGreen – a company that despite considerable struggles has remained one of our industry’s most recognizable brands,” he says. “While private equity firms have been invested in the landscape industry for many years, we expect that this significant expansion of institutional capital in the landscape sector will invigorate M&A activity over the long term.”

In recent years, private investment firms have pumped cash into some of the industry’s largest companies. ValleyCrest, Calabasas, Calif., listed at No. 2 on Lawn & Landscape’s Top 100 list at $940 million; the Brickman Group, Gaithersburg, Md., $687 million and Yellowstone Landscape Group, listed at No. 11, $81 million, are all backed by private capital.

Robert Taylor, president, Yellowstone Landscape Group South Central says he expected many large regional companies would be interested in purchasing parts of TruGreen LandCare if Aurora would sell off branches.

“For our industry, it’s nothing but good. Any private equity play in the green industry is positive for our industry,” Taylor says. “I’m interested to see if Aurora keeps it together, or pulls it apart. … I’m extremely interested to see how it goes.”

He wouldn’t confirm if Yellowstone was included in that group, or that the company had been among those bidding for the whole thing.

Scott Brickman, CEO of the Brickman Group, says any potential purchase of TruGreen LandCare by his company “didn’t fit into our plans,” and that he was unsure of any significant impact the sale has on the industry.

“Glass half full: LandCare gets stronger and they’re good competition with good pricing,” he says. “Irrational competitors with irrational pricing are bad for everybody. We’ve competed against them for years, and it comes down to people and processes. They only way they create value is to improve the profitability of the business.”

Representatives from ValleyCrest declined to comment for this story.

History

The company that became TruGreen LandCare grew out of a then-unprecedented merger of seven multi-million dollar regional landscape companies in 1997.

When it formed, Houston-based LandCare USA had revenue of approximately $120 million and was the largest national landscape maintenance firm in the green industry.

ServiceMaster, TruGreen LandCare’s parent company, bought LandCare USA amid a period of heavy mergers and acquisition activity for the green industry, and less than a year after the newly formed company went public.

Before buying LandCare USA, TruGreen acquired a dozen landscape firms, including The Ruppert Landscape Co., Northwest Landscape Industries, Minor’s Landscape Services and Lifescapes.

In the nine months between its IPO and sale to ServiceMaster, LandCare USA acquired 20 companies and grew to an estimated $237 million in revenue.

But TruGreen – which had seen major success in turning around underperforming lawn care companies – never realized the same gains on the maintenance and construction side of the business.

Recent performance

When combined, TruGreen and LandCare USA had revenue of more than $400 million, but ServiceMaster struggled to integrate its many acquisitions into a cohesive business, and the LandCare division has in recent years lost value. From 2008 to 2010, revenue dropped $78 million, to $238 million.

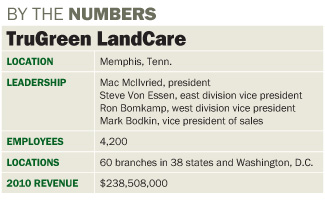

In 2010, TruGreen LandCare reported a 9 percent drop in revenue, to approximately $238 million. In 2009, the company posted revenue of $262 million and $316 million in 2008. The landscape division makes up about 7 percent of ServiceMaster’s total revenue. TruGreen LandCare employs 4,200 people in 60 branches across 38 states.

According to filings with the SEC, LandCare’s drop in revenue included a 9.7 percent decrease in base contract maintenance revenue and a 10 percent decrease in enhancement revenue.

The company cited “contract cancellations and pricing concessions in 2009 and 2010 in response to the impacts of a difficult economic environment” as the causes.

The filings go on to cite “labor inefficiencies created by labor shortages in certain markets and key executive separation charges, offset, in part, by reduced fuel and health care costs and the favorable impact of acquiring assets in connection with exiting certain fleet leases.”

The TruGreen Cos., which included the lawn care and landscape divisions, was listed as the largest company in the green industry on Lawn & Landscape’s 2010 Top 100 list with revenue of $1.3 billion.

LawnCare impact

The sale of its landscape division allows TruGreen to focus on lawn care, which has historically been a stronger segment for the company.

ServiceMaster says the deal would have no impact on its lawn care division, TruGreen LawnCare.

“Our decision to sell to Aurora Resurgence allows us to concentrate on our core residential and commercial businesses,” Hank Mullany, CEO of ServiceMaster, says in a release.

ServiceMaster announced in November of 2010 that it was considering a sale of TruGreen LandCare. According to SEC filings, the company determined in the first quarter that “TruGreen LandCare did not fit within the long-term strategic plans” of its parent company.

The future of LandCare

In an exclusive interview, the owners and management of the new TruGreen LandCare, and its parent company, Aurora Resurgence, sat down with Lawn & Landscape to discuss their plans for the company and how they’ll compete against firms like ValleyCrest and Brickman. – Chuck Bowen

Q: Does Aurora have other investment in the landscape industry? What attracted you to TruGreen LandCare?

Joshua Phillips, managing director, Aurora Resurgence Management Partners: TruGreen LandCare is our first investment in the landscape industry. Our view is that from a macro perspective, we’re in a bit of a trough when it comes to enhancement revenue.

Property owners have held back on some improvement spending in the last couple of years due to the economic environment. And then there’s the attractiveness of the overall business model of TruGreen (LandCare) relative to the contractual nature of recurring revenue business on the maintenance side.

Q: What are your short- and long-term plans for the company? What will change?

Phillips: From our perspective, we’re attracted to the business that we bought. We think there’s a lot of long-term potential to the business. We expect to keep the existing management team in place, led by Mac. We think very highly of Mac and his team, and are very supportive of them running the business.

Mac McIlvried, president, TruGreen LandCare: One fundamental message is that we want our organization and customers to feel positive about this and the stability of the organization going forward. We’re going to take to the leadership team and evolve from there.

We don’t anticipate making any wholesale or disruptive changes to the organization. Being able to focus as a landscape-specific focused company will give us some opportunities that we may not have had in our previous structure.

We were part of a larger organization that at times might have been focused on some other strategic goals.

Q: What are your goals for the company?

Phillips: We’re very focused on growing the business. We have a number of initiatives that we’re working on kicking off to grow within the existing footprint. Of course, we will look at acquisitions. It’s traditionally a part of every portfolio company we work with at Aurora – there is some component of growing by acquisitions.We will evaluate those as they come available.Divestment is not part of our long-term strategy, but as with any business, we’ll do a periodic strategic review to identify parts of the business that may be underperforming.

Q: How will you compete against established commercial maintenance companies like Brickman and ValleyCrest?

Phillips: I do know with a high degree of confidence that the footprint of our business, the service offerings we provide, the resources we have are not substantially different than ValleyCrest or Brickman or other people, and we feel we have the ability to compete head to head with those people any day of the week. It’s a very competitive market. We feel we have the ability to compete and we’ll do our best to grow our business.

McIlvried: I don’t really think there are any market barriers for success. We certainly have an organization that’s capable of competing with anybody. With a singular focus and … some of the support and resources that Aurora will be able to provide, we’re better positioned than ever to go out and compete. We compete successfully in a lot of those markets and we don’t see any reason why we won’t continue to do so.

Q: What’s your 12- to 18-month outlook?

Phillips: Over the next year and a half we expect the footprint to look similar to what it looks like today – if not potentially some additional locations we’d open from organic growth or acquisitions. We’ll have the same leadership team in place and the same organizational structure going forward.

No wholesale changes planned – really just a continued focus on growing the business and driving profitability.

The author is editor and associate publisher of Lawn & Landscape magazine. He can be reached at cbowen@gie.net.

|