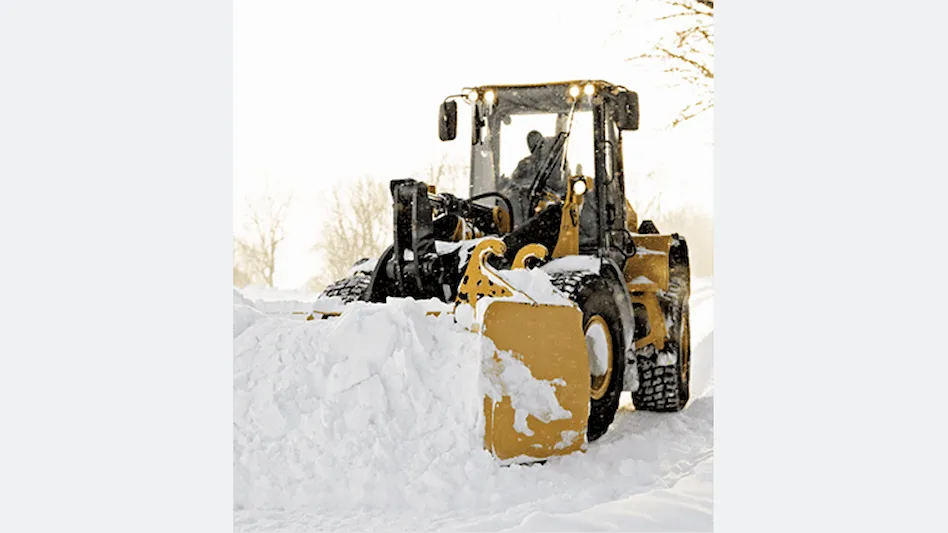

I certainly don’t want to sound like Chicken Little, which is easy to do as we begin to face many unique business and logistical challenges in a post-COVID economy. However, a number of snow professionals have reached out to me about a disturbing equipment trend they believe is emerging throughout the snowbelt that may impact winter operations.

Citing competitive reasons in their respective markets, the majority of these industry insiders wish to speak off the record. However, they all point to some degree of strain on available heavy equipment — loaders, skid-steers, tractors, etc. — for purchase or for lease heading into Winter 2021-22. The consensus is that as soon as equipment arrives at dealerships, it’s being sold. As a result, there is very little to no surplus remaining to serve as rental units for winter snow ops.

“I talked to a couple of skid-steer dealerships and production has slowed,” one Midwest snow contractor told me. “So, they’re selling everything on the lot. I talked to them about renting equipment for this coming winter and they wouldn’t even talk to me about it.

“Typically, dealers have plenty of equipment on their lots and the surplus units are rented to snow contractors in the winter,” the contractor added. “Typically, they’ll cut you a deal on the rental to get it off the lot and making money. But with this run on heavy equipment, I foresee those dealers who do have any equipment will be renting those units at a premium.”

I reached out to Ralph Petta, president and CEO of the Equipment Leasing and Finance Association, who confirms new equipment may be more difficult to find than in the pre-COVID market. While this information does not pertain solely to the professional snow and ice management industry, he adds there is commonality in wheel loaders or skid-steer loaders with the broader construction equipment industry.

Delays and difficulty in getting equipment units to dealerships, in some part, is linked to pressures in the global supply chains for parts, including semi-conductors, Petta says.

“As each country in the world is on a distinct schedule for COVID-19 lockdown, or alternatively, in various stages of re-opening and at various speeds, this has impacted the availability of parts for new heavy machinery manufacturing,” he says. “This includes the United States, where a shortage of lower skilled employees may result in some parts manufacturers reducing output or having closed in the past.

“There are also indications that rental fleet operators are being impacted by the shortage, insofar as they are holding onto existing equipment longer due to continued strong demand and an inability to replace it with new,” Petta adds. “One could conclude that prices for new equipment will rise in response to this situation and that the increase will likely be permanent going forward.”

At this point, it remains debatable how impactful and long-lasting this supply-side situation will be, he adds.

While snow and ice management contractors may see shortages of certain equipment this winter, especially items that traditionally had longer lead times (from order to delivery) in their markets, there are ways to procure the equipment they need to fulfill snow and ice management obligations. Petta suggests contractors pursue new equipment purchases outside of their “traditional” geographic or dealer market, or alternatively, by purchasing used equipment.

“It does not appear that shortages are resulting in a situation where buyers cannot locate equipment anywhere, or at any price,” he adds.