Marc McTeague, partner with SeibertKeck Insurance, has been involved in insuring green industry businesses for about 25 years.

During MGIX 2018, McTeague broke down a few standard areas of insurance and why these things should be covered.

Stuff that sits still. This is your building, the contents inside and any of your inventory. “If you lease your building, you absolutely need water/fire legal liability coverage,” he said.

Anything inside your building is known as “contents,” even if it can be moved. Mowers and other equipment are all considered “contents.”

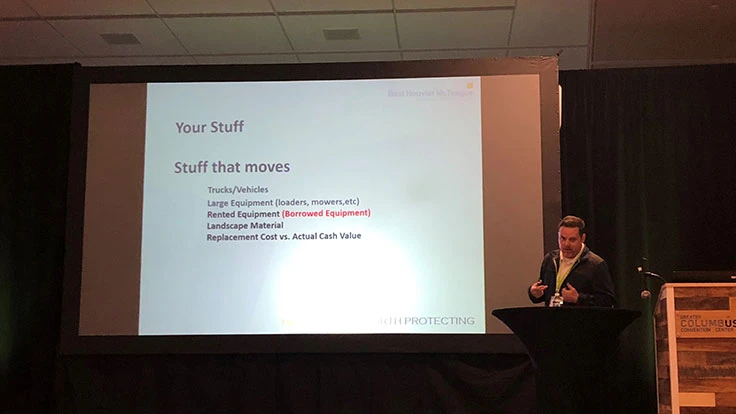

Stuff that moves. Large equipment, trucks, rented equipment and some materials need to be covered by insurance for when they are in transit or operation.

Your people. McTeague said employees can be the most dangerous part of your business in terms of liability. The “people” side of your insurance includes workers’ compensation both in state and out of state and employment practices liability.

“Employment practices liability covers all those ‘isms’ you could encounter,” he said. “This includes racism, sexism, ageism, harassment and wage or hour disputes.”

McTeague said this type of coverage is essentially paying for your attorney if a situation occurs. But, companies need to understand that this may only apply to intracompany incidents. He also suggested having something called key person life insurance. If something were to happen to a key player in your company, there would be life insurance on that person.

Your work. Insuring your work will protect your products, property damage, subcontractor relationships and even mistakes.

“Error and omissions coverage will cover you if you misread a plan and have to restart your entire project. You will have a cushion with that coverage,” he said.

Having insurance on property damage will protect anything that may be damaged while in your care, custody or control. Additionally, when using a subcontractor, they are covered as if they are part of your company with this type of insurance. However, McTeague recommended subcontractors also get their own insurance to be safe.

Your customer. You will be able to insure anything in your care, custody or control on a jobsite. McTeague also considers issues regarding client feelings. These third-party employee policies cover liability claims brought by nonemployees like customers and clients.

The public. Companies should consider additional protections for your business. You’ll also want to look into your liability when it comes to issues in neighboring properties. For instance, if you’re spraying a yard and the wind carries the chemical next door and kills all the flowers.

“You must have an umbrella policy,” McTeague said. “Everyone needs this no matter your size."